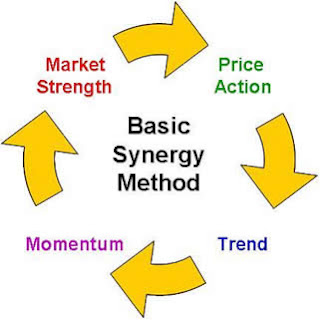

The Synergy Trading Method was developed by Dean Malone and

is an effective Forex trading method developed to simplify trading decisions

with high probability precision. It combines the market forces of Price Action,

Trend, Momentum and Market Strength to produce higher probability trades

With Synergy, traders identify and use two important trading

components in real-time: Price Action and Sentiment.

Price Action is market movement, such as the oscillation of

Open, High, Low and Close prices. Too often, traders are mesmerized by trivial

price flucuations and lose sight of the underlying trend of the market. Many

traders tend to jump in and out of the market instead of staying with the trade

as a trend develops. Synergy is designed to eliminate price distortions. It

reveals periods of market strength and trend and periods of consolidation.

Sentiment is the intuitive feeling or attitude of traders

and investors in the market. For example, if the sentiment of the market is

bullish, then traders and investors expect an upward move in the market. Often,

sentiment is an indication of optimism or pessimism in the market based on

recent news announcements or political events. The Synergy method uses a hybrid

custom indicator developed to show postive (buyers) sentiment or negative

(sellers) sentiment.

Working in unison, Price Action and Sentiment give traders a

distinct trading advantage. When both are in agreement, favorable trading

conditions exists. For instance, when price action is showing upward movement

with buyers sentiment, there is higher probability of a Long position having a

favorable outcome. Similarly, when price action has a downward movement in

conjunction with sellers sentiment, a short position has a favorable outcome

No comments:

Post a Comment